Future skills: leading change at TSB

Future skills are essential for businesses tackling emerging skills gaps. Learn how BPP help TSB future-proof their business.

TSB is a household name in the banking industry, with over 5,000 employees and 220 branches. With the increasing spotlight on future skills as modern organisations embrace digitisation, TSB turned to BPP to empower their employees with the skills they need.

Since 2017, BPP have been the trusted partner of TSB, helping to upskill employees and ensure they have the skills to adapt to the fast pace of changes within the industry. Identifying skills gaps and opportunities for development, BPP delivered a variety of talent solutions.

Apprenticeships and professional development courses, tailored to the needs of the business, have been key to upskilling across TSB. These programmes allow TSB to not only fill skills gaps, but to create the resources to pursue new opportunities and innovate, rather than react, to changes in the industry. They also allow TSB to access the Apprenticeship Levy to fund employee development.

The challenge

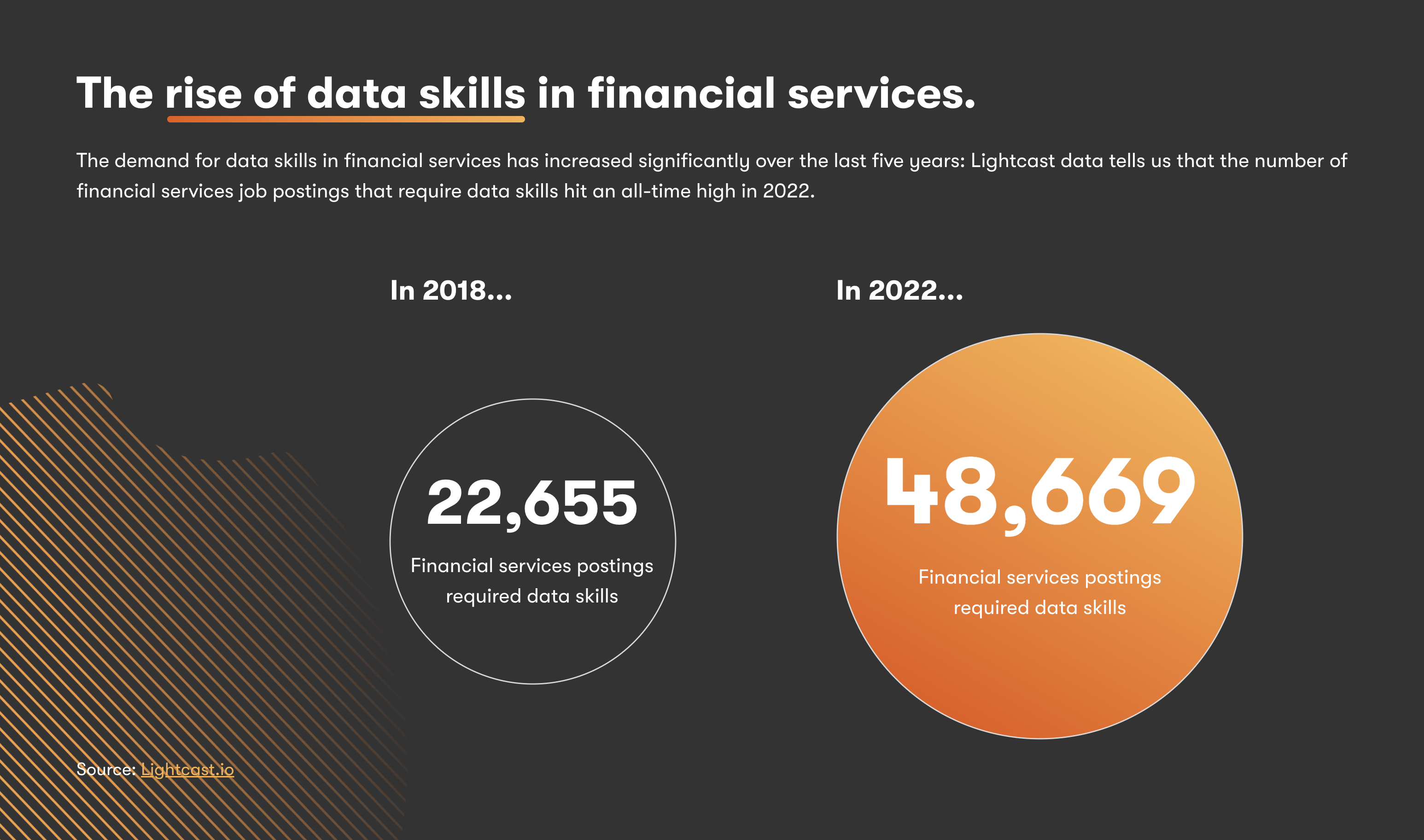

Increasingly, across the financial services industry data and digital skills have become in demand, with job postings more than doubling to 48,669 between 2018 and 2022*.

These skills have been identified as key future skills that will only increase in demand across most industries.

TSB was aware of skills gaps arising across the organisation. With the labour shortages and high rate of competition for these roles, TSB turned to apprenticeship programmes to diversify its digital skills. Recognising the value of employee development, TSB fostered a learning-to-learn culture throughout the organisation. Employees could identify clear career paths as a result of their upskilling, helping to ensure employee retention.

TSB also intends to guarantee a talent pipeline through succession planning, ensuring the business is future-proofed with the skills to address a changing landscape.

The solution

Using the Capability+ analysis, BPP has collaborated with TSB to implement a range of different programmes, tailored to the business. In-demand skills are taught through programmes designed for the precise training objectives required by the business, job function, or role.

These programmes also focus on the business’s anticipated future skills needs. By addressing TSB’s current skills gaps while adapting to future digital and data skills needs, TSB and BPP have implemented a scalable skills model across the business.

Apprenticeship programme spotlight

The Level 3 Data Technician programme enables employees to maximise the value of data by properly utilising digital tools such as Power BI. TSB employees have developed the digital skills to design data models, cleanse data, and transform data through their learning on this programme.

Leaners have made an immediate impact, with in-depth analytics through reports and dashboards. The business now has a more complete look at the data, enabling more considered and data-driven decisions to be made.

The Level 3 Data Technician programme was tailored for TSB’s needs, and initially launched to 15 people within the organisation who wanted to re-skill in a different business area. This saved money on a lengthy recruitment process in a difficult labour market and provided value to employees through a commitment to upskilling.

The success

TSB’s 15 employees on the Level 3 Data Technician programme are expected to complete the programme by August 2023. Of the 15, 40% have already received internal promotions into data roles. All 15 have remained within the business, showing the value of upskilling in promoting employee retention.

TSB has implemented a training pipeline which delivers skills the organisation needs now, and the future skills to respond to rapid technology changes. This was made possible through the Apprenticeship Levy.

“One apprentice while on programme secured a permanent position within our Business Banking Financial Crime and Data Quality Control teams, who now leads a team delivering critical reports through the network, protecting both the bank and our customers, while supporting business decisions in an ever-evolving business area.”

Richard Hurlock-Norton, Future Skills Manager at TSB

Final thoughts

BPP’s partnership with TSB aimed at promoting future skills has been a success. Rather than implementing an off-the-shelf plan, TSB’s upskilling was targeted at critical areas within the business.

BPP understood TSB’s industry, business, and data requirements

BPP reacts quickly to the changing market TSB works in, paying attention to the strategic drivers and ROI metrics TSB has built

Understanding future skills needs, BPP was able to build a compelling business case for senior management

Learners quickly took to the programmes, implementing their new skills in the workplace from day-one. With new skills and experience to bring to the company, learners were more motivated to stay within and develop with the TSB.

BPP and TSB created a bespoke learning programme aligned to TSB’s vision and values, integrating learning with TSB case studies

Working together to identify skills gaps across the business, BPP was able to build content to fill skills gaps and become adaptable to future skills needs

How can BPP’s data training can promote long-term future skills in your business?

*Data from Lightcast.